安森美半导体发布2018年第4季度及全年业绩

时间:2019-02-12 11:07来源:21Dianyuan

摘要:2018年第4季度总收入为1,5031百万美元,较去年同一季度上升约9%。2018年第4季度的收入较2018年第3季度下跌约3%。

2018年第4季度业绩摘要:

• 总收入1,503.1百万美元

• 毛利率为37.9%

• 公认会计原则 (GAAP)营运毛利率为14.8%,非公认会计原则 (non-GAAP)营运毛利率为16.8%

• 营运现金流为421.0百万美元及可用的流动现金为289.0百万美元

• GAAP每股盈利为0.39美元,non-GAAP每股盈利为0.53美元

2018年业绩摘要:

• 总收入5,878.3百万美元

• 毛利率为38.1%

• GAAP营运毛利率为14.4%,non-GAAP营运毛利率为16.7%

• 营运现金流为1,274.2百万美元及可用的流动现金为759.4百万美元

• GAAP每股盈利为1.44美元,non-GAAP每股盈利为1.96美元

2019年2月12日 – 安森美半导体公司 (ON Semiconductor Corporation,美国纳斯达克上市代号:ON) 于美国时间2月1日宣布,2018年第4季度总收入为1,503.1百万美元,较去年同一季度上升约9%。2018年第4季度的收入较2018年第3季度下跌约3%。

安森美半导体总裁兼首席执行官傑克信 (Keith Jackson) 说:“我们再次在第4季度取得强劲的业绩,尽管宏观经济情况放缓。推动汽车,工业和云计算终端市场电子成分增长的关键长期趋势维持不变,我们对中长期前景保持乐观。我们战略市场酝酿中的设计导入量产增长势头强劲,我们与客户的互动也在加强,而我们的竞争地位正在显着提高。尽管我们对中长期前景充满信心,但我们意识到宏观经济放缓,正审慎管理我们的业务,以调整应对不断变化的需求环境。”

“连同强劲的收入表现,我们会继续以很强的营运执行力,提供稳健的利润率和可用的流动现金。”

第4季度主要流动现金项目

*上一期间的金额已就追溯性采纳ASU 2017-07 - 「改善定期退休金成本净额及定期退休后福利成本净额的呈列」(「ASU 2017-07」)作出调整。根据ASU 2017-07,服务成本包括于经营收入内,而其他成分于经营收入之外呈报。采纳该准则对本期及上期财务报表并无重大影响。

2019年第1季度展望

按现时产品订单趋势、未完成订单水平和估计周转水平,本公司预计2019年第1季度的收入总额将约为1,365百万美元至1,415百万美元。2019年第1季度的毛利率展望包括安森美半导体会津株式会社 (ON Semiconductor Aizu Co., Ltd.) 提供制造服务的负面影响的50个基点。

2019年第1季的度展望包括以股票支付报酬的预期支出约19百万美元至21百万美元。预期缴付所得税的净现金为16百万美元至20百万美元。

下表概列安森美半导体2019年第1季度的GAAP及non-GAAP展望。

FINANCIALS

* Convertible Notes, Non-cash Interest Expense is calculated pursuant to FASB’s Accounting Standards Codification Topic 470: Debt.

** Diluted share count can vary as a result of, among other things, the actual exercise of options or vesting of restricted stock units, the incremental dilutive shares from the Company's convertible senior subordinated notes, and the repurchase or the issuance of stock or convertible notes or the sale of treasury shares. In periods in which the quarterly average stock price per share exceeds $18.50, the non-GAAP diluted share count and non-GAAP net income per share includes the impact of the Company’s hedge transactions issued concurrently with our 1.00% convertible notes. As such, at an average stock price per share between $18.50 and $25.96, the hedging activity offsets the potentially dilutive effect of the 1.00% convertible notes. In periods when the quarterly average stock price per share exceeds $20.72, the non-GAAP diluted share count and non-GAAP net income per share includes the anti-dilutive impact of the Company’s hedge transactions issued concurrently with the 1.625% convertible notes. As such, at an average stock price per share between $20.72 and $30.70, the hedging activity offsets the potentially dilutive effect of the 1.625% convertible notes. Both GAAP and non-GAAP diluted share counts are based on the Company’s stock price as of December 31, 2018.

*** Special items may include: amortization of acquisition-related intangibles; expensing of appraised inventory fair market value step-up; purchased in-process research and development expenses; restructuring, asset impairments and other, net; goodwill impairment charges; gains and losses on debt prepayment; non-cash interest expense; actuarial (gains) losses on pension plans and other pension benefits; and certain other special items, as necessary. These special items are out of our control and could change significantly from period to period. As a result, we are not able to reasonably estimate and separately present the individual impact of these special items, and we are similarly unable to provide a reconciliation of the non-GAAP measures. The reconciliation that is unavailable would include a forward looking income statement, balance sheet and statement of cash flows in accordance with GAAP. For this reason, we use a projected range of the aggregate amount of special items in order to calculate our projected non-GAAP operating expense outlook.

**** We believe these non-GAAP measures provide important supplemental information to investors. We use these measures, together with GAAP measures, for internal managerial purposes and as a means to evaluate period-to-period comparisons. However, we do not, and you should not, rely on non-GAAP financial measures alone as measures of our performance. We believe that non-GAAP financial measures reflect an additional way of viewing aspects of our operations that, when taken together with GAAP results and the reconciliations to corresponding GAAP financial measures that we also provide in our releases, provide a more complete understanding of factors and trends affecting our business. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other companies' non-GAAP financial measures, even if they have similar names.

电话会议

安森美半导体将于美国时间2019年2月4日美国东部时间 (EST)上午9时为财经界举行电话会议,讨论安森美半导体此公告和2018年第4季度及全年的业绩。英语电话会议将在公司网站http://www.onsemi.cn的“投资者关系”网页作实时广播。实时网上广播大约1小时后在该网站回放,为时30天。投资者及有兴趣者如想参加业绩报告英语电话会议,请拨877-356-3762 (美国/加拿大),或1-262-558-6155(国际),并提供该会议的ID号码 —9592878。

关于安森美半导体

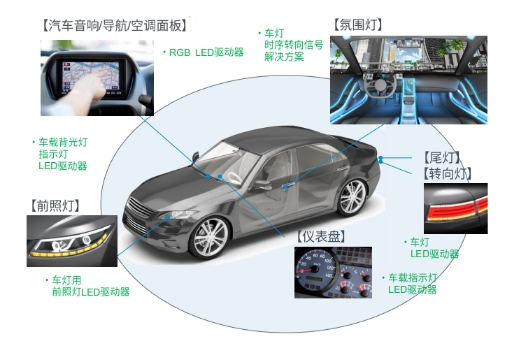

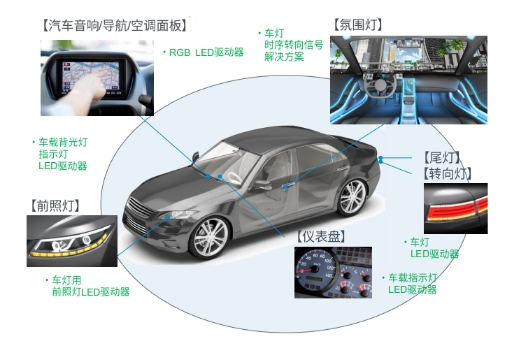

安森美半导体(ON Semiconductor,美国纳斯达克上市代号:ON)致力于推动高能效电子的创新,使客户能够减少全球的能源使用。安森美半导体领先于供应基于半导体的方案,提供全面的高能效电源管理、模拟、传感器、逻辑、时序、互通互联、分立、系统单芯片(SoC)及定制器件阵容。公司的产品帮助工程师解决他们在汽车、通信、计算机、消费电子、工业、医疗、航空及国防应用的独特设计挑战。公司运营敏锐、可靠、世界一流的供应链及品质项目,一套强有力的守法和道德规范计划,及在北美、欧洲和亚太地区之关键市场运营包括制造厂、销售办事处及设计中心在内的业务网络。更多信息请访问http://www.onsemi.cn。

安森美半导体和安森美半导体图标是 Semiconductor Components Industries, LLC的注册商标。所有本文中出现的其它品牌和产品名称分别为其相应持有人的注册商标或商标。虽然公司在本新闻稿提及其网站,但此稿并不包含其网站中有关的信息。

This document contains “forward-looking statements,” as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, included or incorporated in this document could be deemed forward-looking statements, particularly statements about the future financial performance of ON Semiconductor, including financial guidance for the year ending December 31, 2019. Forward-looking statements are often characterized by the use of words such as “believes,” “estimates,” “expects,” “projects,” “may,” “will,” “intends,” “plans,” or “anticipates” or by discussions of strategy, plans, or intentions. All forward-looking statements in this document are made based on our current expectations, forecasts, estimates, and assumptions and involve risks, uncertainties, and other factors that could cause results or events to differ materially from those expressed in the forward-looking statements. These factors include, among other things: our revenue and operating performance; economic conditions and markets (including current financial conditions); risks related to our ability to meet our assumptions regarding outlook for revenue and gross margin as a percentage of revenue; effects of exchange rate fluctuations; the cyclical nature of the semiconductor industry; changes in demand for our products; changes in inventories at our customers and distributors; technological and product development risks; enforcement and protection of our intellectual property rights and related risks; risks related to the security of our information systems and secured network; availability of raw materials, electricity, gas, water, and other supply chain uncertainties; our ability to effectively shift production to other facilities when required in order to maintain supply continuity for our customers; variable demand and the aggressive pricing environment for semiconductor products; our ability to successfully manufacture in increasing volumes on a cost-effective basis and with acceptable quality for our current products; risks associated with our acquisition of Fairchild Semiconductor International, Inc. and with other acquisitions and dispositions, including our ability to realize the anticipated benefits of our acquisitions and dispositions; risks that acquisitions or dispositions may disrupt our current plans and operations, the risk of unexpected costs, charges, or expenses resulting from acquisitions or dispositions and difficulties arising from integrating and consolidating acquired businesses, our timely filing of financial information with the Securities and Exchange Commission (“SEC”) for acquired businesses, and our ability to accurately predict the future financial performance of acquired businesses); competitor actions, including the adverse impact of competitor product announcements; pricing and gross profit pressures; loss of key customers or distributors; order cancellations or reduced bookings; changes in manufacturing yields; control of costs and expenses and realization of cost savings and synergies from restructurings; significant litigation; risks associated with decisions to expend cash reserves for various uses in accordance with our capital allocation policy such as debt prepayment, stock repurchases, or acquisitions rather than to retain such cash for future needs; risks associated with our substantial leverage and restrictive covenants in our debt agreements that may be in place from time to time; risks associated with our worldwide operations, including changes in trade policies, foreign employment and labor matters associated with unions and collective bargaining arrangements, as well as man-made and/or natural disasters affecting our operations or financial results; the threat or occurrence of international armed conflict and terrorist activities both in the United States and internationally; risks of changes in U.S. or international tax rates or legislation, including the impact of the recent U.S. tax legislation; risks and costs associated with increased and new regulation of corporate governance and disclosure standards; risks related to new legal requirements; and risks involving environmental or other governmental regulation. Additional factors that could affect our future results or events are described under Part I, Item 1A “Risk Factors” in our 2017 Annual Report on Form 10-K filed with the SEC on February 21, 2018 (our "2017 Form 10-K"), Part II, Item IA "Risk Factors" in our Form 10-Q for the quarter ended March 30, 2018 (our "First Quarter 10-Q"), our Form 10-Q for the quarter ended June 29, 2018 (our "Second Quarter 10-Q"), and our Form 10-Q for the quarter ended September 28, 2018 (our "Third Quarter 10-Q"), and from time-to-time in our other SEC reports. Readers are cautioned not to place undue reliance on forward-looking statements. We assume no obligation to update such information, except as may be required by law. You should carefully consider the trends, risks, and uncertainties described in this document, our 2017 Form 10-K, our First Quarter 10-Q, our Second Quarter 10-Q, our Third Quarter 10-Q, and other reports filed with or furnished to the SEC before making any investment decision with respect to our securities. If any of these trends, risks, or uncertainties actually occurs or continues, our business, financial condition, or operating results could be materially adversely affected, the trading prices of our securities could decline, and you could lose all or part of your investment. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

• 总收入1,503.1百万美元

• 毛利率为37.9%

• 公认会计原则 (GAAP)营运毛利率为14.8%,非公认会计原则 (non-GAAP)营运毛利率为16.8%

• 营运现金流为421.0百万美元及可用的流动现金为289.0百万美元

• GAAP每股盈利为0.39美元,non-GAAP每股盈利为0.53美元

2018年业绩摘要:

• 总收入5,878.3百万美元

• 毛利率为38.1%

• GAAP营运毛利率为14.4%,non-GAAP营运毛利率为16.7%

• 营运现金流为1,274.2百万美元及可用的流动现金为759.4百万美元

• GAAP每股盈利为1.44美元,non-GAAP每股盈利为1.96美元

2019年2月12日 – 安森美半导体公司 (ON Semiconductor Corporation,美国纳斯达克上市代号:ON) 于美国时间2月1日宣布,2018年第4季度总收入为1,503.1百万美元,较去年同一季度上升约9%。2018年第4季度的收入较2018年第3季度下跌约3%。

安森美半导体总裁兼首席执行官傑克信 (Keith Jackson) 说:“我们再次在第4季度取得强劲的业绩,尽管宏观经济情况放缓。推动汽车,工业和云计算终端市场电子成分增长的关键长期趋势维持不变,我们对中长期前景保持乐观。我们战略市场酝酿中的设计导入量产增长势头强劲,我们与客户的互动也在加强,而我们的竞争地位正在显着提高。尽管我们对中长期前景充满信心,但我们意识到宏观经济放缓,正审慎管理我们的业务,以调整应对不断变化的需求环境。”

“连同强劲的收入表现,我们会继续以很强的营运执行力,提供稳健的利润率和可用的流动现金。”

第4季度业绩(GAAP)

| (百万美元, 每股数据除外) |

2018年第4季度 | 2017年第4季度* | 同比变动 | 2018年第3季度 | 环比变动 |

| 收入 | $1,503.1 | $1,377.5 | 9% | $1,541.7 | (3)% |

| 毛利 | $569.7 | $516.5 | 10% | $596.6 | (5)% |

| 营运收入 | $222.7 | $167.5 | 33% | $241.6 | (8)% |

| 安森美半导体公司 应占收入净额 |

$165.6 | $529.9 | (69)% | $166.9 | (1)% |

| 每股摊薄盈利 | $0.39 | $1.22 | (68)% | $0.38 | 3% |

| 摊薄股数 | 420 | 433.3 | (3)% | 435.3 | (4)% |

第4季度业绩(non-GAAP)

| (百万美元) | 2018年第4季度 | 2017年第4季度* | 同比变动 | 2018年第3季度 | 环比变动 |

| 收入 | $1,503.1 | $1,377.5 | 9% | $1,541.7 | (3)% |

| 毛利 | $570.3 | $516.5 | 10% | $596.8 | (4)% |

| 营运收入 | $253.0 | $211.1 | 20% | $275.1 | (8)% |

| 安森美半导体公司 应占收入净额 |

$222.0 | $167.3 | 33% | $244.9 | (9)% |

| 每股摊薄盈利 | $0.53 | $0.39 | 36% | $0.57 | (7)% |

| 摊薄股数 | 420.0 | 429.9 | (2)% | 429.4 | (2)% |

第4季度主要流动现金项目

| (百万美元) | 2018年第4季度 | 2017年第4季度* | 同比变动 | 2017年第3季度 | 环比变动 |

| 现金税 | $8.2 | $18.9 | (57)% | $12.6 | (35)% |

| 营运现金流 | $421.0 | $224.3 | 88% | $358.2 | 18% |

| 可用的流动现金 | $289.0 | $48.6 | 495% | $227.8 | 27% |

2019年第1季度展望

按现时产品订单趋势、未完成订单水平和估计周转水平,本公司预计2019年第1季度的收入总额将约为1,365百万美元至1,415百万美元。2019年第1季度的毛利率展望包括安森美半导体会津株式会社 (ON Semiconductor Aizu Co., Ltd.) 提供制造服务的负面影响的50个基点。

2019年第1季的度展望包括以股票支付报酬的预期支出约19百万美元至21百万美元。预期缴付所得税的净现金为16百万美元至20百万美元。

下表概列安森美半导体2019年第1季度的GAAP及non-GAAP展望。

| 安森美半导体 GAAP总额 |

特别项目*** | 安森美半导体 non-GAAP总额**** |

|

| 收入 | $1,365百万美元至 $1,415 百万美元 |

- | $1,365百万美元至 $1,415百万美元 |

| 毛利率 | 36.4%至37.4% | - | 36.4%至37.4% |

| 营运支出 | $330百万美元至 $348百万美元 |

$30百万美元至 $34百万美元* |

$300百万美元至 $314百万美元 |

| 其他收入及支出净额(包括利息支出) | $31百万美元至 $34 百万美元 |

$9百万美元至 $10百万美元 |

$22百万美元至 $24百万美元 |

| 摊薄股数** | 420 百万 | - | 420百万 |

* Convertible Notes, Non-cash Interest Expense is calculated pursuant to FASB’s Accounting Standards Codification Topic 470: Debt.

** Diluted share count can vary as a result of, among other things, the actual exercise of options or vesting of restricted stock units, the incremental dilutive shares from the Company's convertible senior subordinated notes, and the repurchase or the issuance of stock or convertible notes or the sale of treasury shares. In periods in which the quarterly average stock price per share exceeds $18.50, the non-GAAP diluted share count and non-GAAP net income per share includes the impact of the Company’s hedge transactions issued concurrently with our 1.00% convertible notes. As such, at an average stock price per share between $18.50 and $25.96, the hedging activity offsets the potentially dilutive effect of the 1.00% convertible notes. In periods when the quarterly average stock price per share exceeds $20.72, the non-GAAP diluted share count and non-GAAP net income per share includes the anti-dilutive impact of the Company’s hedge transactions issued concurrently with the 1.625% convertible notes. As such, at an average stock price per share between $20.72 and $30.70, the hedging activity offsets the potentially dilutive effect of the 1.625% convertible notes. Both GAAP and non-GAAP diluted share counts are based on the Company’s stock price as of December 31, 2018.

*** Special items may include: amortization of acquisition-related intangibles; expensing of appraised inventory fair market value step-up; purchased in-process research and development expenses; restructuring, asset impairments and other, net; goodwill impairment charges; gains and losses on debt prepayment; non-cash interest expense; actuarial (gains) losses on pension plans and other pension benefits; and certain other special items, as necessary. These special items are out of our control and could change significantly from period to period. As a result, we are not able to reasonably estimate and separately present the individual impact of these special items, and we are similarly unable to provide a reconciliation of the non-GAAP measures. The reconciliation that is unavailable would include a forward looking income statement, balance sheet and statement of cash flows in accordance with GAAP. For this reason, we use a projected range of the aggregate amount of special items in order to calculate our projected non-GAAP operating expense outlook.

**** We believe these non-GAAP measures provide important supplemental information to investors. We use these measures, together with GAAP measures, for internal managerial purposes and as a means to evaluate period-to-period comparisons. However, we do not, and you should not, rely on non-GAAP financial measures alone as measures of our performance. We believe that non-GAAP financial measures reflect an additional way of viewing aspects of our operations that, when taken together with GAAP results and the reconciliations to corresponding GAAP financial measures that we also provide in our releases, provide a more complete understanding of factors and trends affecting our business. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other companies' non-GAAP financial measures, even if they have similar names.

电话会议

安森美半导体将于美国时间2019年2月4日美国东部时间 (EST)上午9时为财经界举行电话会议,讨论安森美半导体此公告和2018年第4季度及全年的业绩。英语电话会议将在公司网站http://www.onsemi.cn的“投资者关系”网页作实时广播。实时网上广播大约1小时后在该网站回放,为时30天。投资者及有兴趣者如想参加业绩报告英语电话会议,请拨877-356-3762 (美国/加拿大),或1-262-558-6155(国际),并提供该会议的ID号码 —9592878。

关于安森美半导体

安森美半导体(ON Semiconductor,美国纳斯达克上市代号:ON)致力于推动高能效电子的创新,使客户能够减少全球的能源使用。安森美半导体领先于供应基于半导体的方案,提供全面的高能效电源管理、模拟、传感器、逻辑、时序、互通互联、分立、系统单芯片(SoC)及定制器件阵容。公司的产品帮助工程师解决他们在汽车、通信、计算机、消费电子、工业、医疗、航空及国防应用的独特设计挑战。公司运营敏锐、可靠、世界一流的供应链及品质项目,一套强有力的守法和道德规范计划,及在北美、欧洲和亚太地区之关键市场运营包括制造厂、销售办事处及设计中心在内的业务网络。更多信息请访问http://www.onsemi.cn。

安森美半导体和安森美半导体图标是 Semiconductor Components Industries, LLC的注册商标。所有本文中出现的其它品牌和产品名称分别为其相应持有人的注册商标或商标。虽然公司在本新闻稿提及其网站,但此稿并不包含其网站中有关的信息。

This document contains “forward-looking statements,” as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, included or incorporated in this document could be deemed forward-looking statements, particularly statements about the future financial performance of ON Semiconductor, including financial guidance for the year ending December 31, 2019. Forward-looking statements are often characterized by the use of words such as “believes,” “estimates,” “expects,” “projects,” “may,” “will,” “intends,” “plans,” or “anticipates” or by discussions of strategy, plans, or intentions. All forward-looking statements in this document are made based on our current expectations, forecasts, estimates, and assumptions and involve risks, uncertainties, and other factors that could cause results or events to differ materially from those expressed in the forward-looking statements. These factors include, among other things: our revenue and operating performance; economic conditions and markets (including current financial conditions); risks related to our ability to meet our assumptions regarding outlook for revenue and gross margin as a percentage of revenue; effects of exchange rate fluctuations; the cyclical nature of the semiconductor industry; changes in demand for our products; changes in inventories at our customers and distributors; technological and product development risks; enforcement and protection of our intellectual property rights and related risks; risks related to the security of our information systems and secured network; availability of raw materials, electricity, gas, water, and other supply chain uncertainties; our ability to effectively shift production to other facilities when required in order to maintain supply continuity for our customers; variable demand and the aggressive pricing environment for semiconductor products; our ability to successfully manufacture in increasing volumes on a cost-effective basis and with acceptable quality for our current products; risks associated with our acquisition of Fairchild Semiconductor International, Inc. and with other acquisitions and dispositions, including our ability to realize the anticipated benefits of our acquisitions and dispositions; risks that acquisitions or dispositions may disrupt our current plans and operations, the risk of unexpected costs, charges, or expenses resulting from acquisitions or dispositions and difficulties arising from integrating and consolidating acquired businesses, our timely filing of financial information with the Securities and Exchange Commission (“SEC”) for acquired businesses, and our ability to accurately predict the future financial performance of acquired businesses); competitor actions, including the adverse impact of competitor product announcements; pricing and gross profit pressures; loss of key customers or distributors; order cancellations or reduced bookings; changes in manufacturing yields; control of costs and expenses and realization of cost savings and synergies from restructurings; significant litigation; risks associated with decisions to expend cash reserves for various uses in accordance with our capital allocation policy such as debt prepayment, stock repurchases, or acquisitions rather than to retain such cash for future needs; risks associated with our substantial leverage and restrictive covenants in our debt agreements that may be in place from time to time; risks associated with our worldwide operations, including changes in trade policies, foreign employment and labor matters associated with unions and collective bargaining arrangements, as well as man-made and/or natural disasters affecting our operations or financial results; the threat or occurrence of international armed conflict and terrorist activities both in the United States and internationally; risks of changes in U.S. or international tax rates or legislation, including the impact of the recent U.S. tax legislation; risks and costs associated with increased and new regulation of corporate governance and disclosure standards; risks related to new legal requirements; and risks involving environmental or other governmental regulation. Additional factors that could affect our future results or events are described under Part I, Item 1A “Risk Factors” in our 2017 Annual Report on Form 10-K filed with the SEC on February 21, 2018 (our "2017 Form 10-K"), Part II, Item IA "Risk Factors" in our Form 10-Q for the quarter ended March 30, 2018 (our "First Quarter 10-Q"), our Form 10-Q for the quarter ended June 29, 2018 (our "Second Quarter 10-Q"), and our Form 10-Q for the quarter ended September 28, 2018 (our "Third Quarter 10-Q"), and from time-to-time in our other SEC reports. Readers are cautioned not to place undue reliance on forward-looking statements. We assume no obligation to update such information, except as may be required by law. You should carefully consider the trends, risks, and uncertainties described in this document, our 2017 Form 10-K, our First Quarter 10-Q, our Second Quarter 10-Q, our Third Quarter 10-Q, and other reports filed with or furnished to the SEC before making any investment decision with respect to our securities. If any of these trends, risks, or uncertainties actually occurs or continues, our business, financial condition, or operating results could be materially adversely affected, the trading prices of our securities could decline, and you could lose all or part of your investment. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

免责声明:本文若是转载新闻稿,转载此文目的是在于传递更多的信息,版权归原作者所有。文章所用文字、图片、视频等素材如涉及作品版权问题,请联系本网编辑予以删除。

我要投稿

近期活动

- 安森美汽车&能源基础设施白皮书下载活动时间:2024年04月01日 - 2024年10月31日[立即参与]

- 2023年安森美(onsemi)在线答题活动时间:2023年09月01日 - 2023年09月30日[查看回顾]

- 2023年安森美(onsemi)在线答题活动时间:2023年08月01日 - 2023年08月31日[查看回顾]

- 【在线答题活动】PI 智能家居热门产品,带您领略科技智慧家庭时间:2023年06月15日 - 2023年07月15日[查看回顾]

- 2023年安森美(onsemi)在线答题活动时间:2023年06月01日 - 2023年06月30日[查看回顾]

分类排行榜

- 汽车电子电源行业可靠性要求,你了解多少?

- 内置可编程模拟功能的新型 Renesas Synergy™ 低功耗 S1JA 微控制器

- Vishay 推出高集成度且符合 IrDA® 标准的红外收发器模块

- ROHM 发布全新车载升降压电源芯片组

- 艾迈斯半导体推出行业超薄的接近/颜色传感器模块,助力实现无边框智能手机设计

- 艾迈斯半导体与 Qualcomm Technologies 集中工程优势开发适用于手机 3D 应用的主动式立体视觉解决方案

- 维谛技术(Vertiv)同时亮相南北两大高端峰会,精彩亮点不容错过

- 缤特力推出全新商务系列耳机 助力解决开放式办公的噪音难题

- CISSOID 和泰科天润(GPT)达成战略合作协议,携手推动碳化硅功率器件的广泛应用

- 瑞萨电子推出 R-Car E3 SoC,为汽车大显示屏仪表盘带来高端3D 图形处理性能

编辑推荐

小型化和稳定性如何兼得?ROHM 推出超小型高输出线性 LED 驱动器 IC,为插座型 LED 驱动 IC 装上一颗强有力的 “心脏”

众所周知,LED的驱动IC担负着在输入电压不稳定的情况下,为LED提供恒定的电流,并控制恒定(可调)亮度的作用。无论是室内照明,还是车载应用,都肩负着极为重要的使命。

- 关于反激电源效率的一个疑问

时间:2022-07-12 浏览量:10154

- 面对热拔插阐述的瞬间大电流怎么解决

时间:2022-07-11 浏览量:8915

- PFC电路对N线进行电压采样的目的是什么

时间:2022-07-08 浏览量:9555

- RCD中的C对反激稳定性有何影响

时间:2022-07-07 浏览量:7176

- 36W单反激 传导7~10M 热机5分钟后超标 不知道哪里出了问题

时间:2022-07-07 浏览量:5951

- PFC电感计算

时间:2022-07-06 浏览量:4159

- 多相同步BUCK

时间:2010-10-03 浏览量:37861

- 大家来讨论 系列之二:开机浪涌电流究竟多大?

时间:2016-01-12 浏览量:43155

- 目前世界超NB的65W适配器

时间:2016-09-28 浏览量:60017

- 精讲双管正激电源

时间:2016-11-25 浏览量:128069

- 利用ANSYS Maxwell深入探究软磁体之----电感变压器

时间:2016-09-20 浏览量:107546

- 【文原创】认真的写了一篇基于SG3525的推挽,附有详细..

时间:2015-08-27 浏览量:100266